-

Digital Transformation has Disrupted the PRM & TCMA Software Markets

Almost every industry is morphing to an “as-a-service” business model based upon digital interactions. But eBusiness/eCommerce has not taken work away from channel partners (there has been no “dis-intermediation”). No, the channel has become even more influential and advocational for all businesses. However, channel partners are now more likely to live off revenues earned from the buyers, than from the manufacturer they now, only occasionally, represent.

Plus, in addition to resellers or distributors, we now have channel players called affiliates, referrers, associations, communities, groups, ambassadors. Most importantly, the whole relationship is now primarily based upon digital interactions and depends less on partner account managers on the street.

When I started out in 2019 as an independent analyst, my first research report on this topic was titled Channel Marketing and Enablement – intended to cover all marketing processes where a manufacturer or vendor distributes products and services through partner organizations as their indirect channel. Channel marketing is a form of brand content management; where programs, promotions and leads are managed both down and up the channel (also called Local/Distributed Marketing or Through-Channel Marketing Automation (TCMA)). Channel Enablement are processes around the partner relationship itself: recruitment, registration and classification, contractual details, information exchange, and more (usually labelled Partner Relationship Management (PRM)). (Before that, at Forrester, I had managed separate Forrester Wave projects for TCMA and for PRM).

In today’s world, I do not think that traditional PRM or TCMA is enough for any company that is working, marketing, and selling in a true digital manner. Most manufacturers have a channel software stack consisting of many parts; perhaps a TCMA system, plus a PRM, and usually other software tools that the PRM does not cover. With smaller volumes and, more-or-less, manual channel management, this was less problematic.

In a more digital business world, with higher volumes of transactions, transaction types, partners, and partner types, companies will want a more comprehensive and, more importantly, fully integrated platform for Partner Management Automation. So that is how I approached my later research into channel management.

In 2022, I had already highlighted many vendors preferring to stick to their traditional offering of just a PRM platform or just TCMA: happy to do “business as usual” and find clients who wanted the same. But with the digital transformation of channel management, many of those vendors will now run out of addressable clients. They may even lose much of their installed base as they, their customers, transform their channels. Our research even shows that few of them are equipped to cover the even-wider requirements of PMA in a cloud-based, digital, eCommerce-dominated world with a much-more complex ecosystem of partnerships.

Who is in the PMA Vendor Landscape?

Within the nineteen vendors scored by the 1,500 survey participants, 12 vendors, including some interesting new entrants in this report, are in the Market Leaders category, having both a total Strategy and Execution score of over 4 out of 5: ALLBOUND, APPDIRECT, CHANNEL MECHANICS, CHANNELTIVITY, IMPACT, IMPARTNER, MAGENTRIX, PARTNERSTACK, SALESFORCE, 360 INSIGHTS, ZIFT SOLUTIONS, and ZINFI.

The full list was completed by these vendors: ANSIRA, BRIDGELINE DIGITAL, CHANNELEXPERTS, CROSSBEAM, MINDMATRIX, SPROUDLOUD, and WEBINFINTY

We plan to publish the report later in February. Contact me if you’d like to hear more about this research.

Always keeping you informed! Peter

-

New Vendor Spotlight

As the resident “Lead Analyst” within their Propolis service, I’ve been working with the B2B Marketing organization for many years now. Launched in March 2021 as an exclusive digital community for B2B marketers, Propolis has collected, by design, a very diverse membership, not just marketing executives but entire marketing teams in companies of all sizes.

I think that Propolis has proven to be nothing less than a game changer for B2B marketing as an industry, as a profession, and most of all as a community. After all, the way that business professionals want to consume and discuss industry and disciplinary trends has changed to become much more:

- Digital. Meaning that there is interactivity, not just website documents.

- Democratized. Where all job levels can afford to benefit from the information.

- Discussion-based. Where peer inputs are valued just as much as the so-called experts.

In the next weeks we will be extending our coverage and publishing our first B2B Marketing Martech Vendor Spotlight report, this edition focused on vendors supporting Account-Based Marketing (ABM).

When I was asked to design and research the Spotlight report, I realized that here was a great chance to create something different than the classical research analyst reports available so far. Those waves and quadrants score and compare the vendors based primarily on their product offering. My experience helping B2B marketers in their vendor selection process (I often recommend using Design Thinking) has been that the supplier itself is equally, or perhaps even more, the focus of attention and evaluation. No, the make-or-break questions that I get asked in my workshops are more about how a vendor will work with them as a client:

- “Will they help us to set up and run the solution?”

- “How do they react when something goes wrong?”

- “Do they have programmes to help ensure we get a return on our investment?”

So, first we select and spotlight those vendors we feel are most relevant and important for the Propolis members (a mix of both large enterprise and small-medium sized businesses). Then we profile each vendor and score it on four criteria relevant to the topics listed above. We also field a detailed vendor questionnaire asking about the resources in place to ensure successful implementation, integration, user adoption, and even value management of their ABM solution. Not every vendor responds and completes the survey (yet – as this is the first report after all) but my 20+ years of working at META Group, Gartner and Forrester Research, plus seven years of user surveys and report writing for Research In Action, is experience enough for me to craft and score all the profile pages.

These four criteria are critically important to potential buyer teams when evaluating and shortlisting vendors and the stress being on CUSTOMER SUCCESS more than individual product features:

• Market Momentum. Here, we have assessed how well a vendor helps prospective buyers to understand the solution offering and how it fits into their environment.

• Customer Focus. Almost all software solutions are now delivered as-a-service and the most successful SaaS vendors are those who help their clients on an ongoing basis, not just in response to support calls.

• Price vs Value. As with any business investment, marketing executives need to be assured that the investments they make in technology are providing an appropriate payback.

• Implementation Success. The true test of a business partnership is the commitment from a vendor to supporting the integration of their system with whatever the client has in place already.

We score each criterion as Strong, Good, Medium, or Low.

The B2B Marketing Martech Vendor Spotlight Report on ABM will be published to Propolis clients during the The Global ABM Conference from B2B Marketing in London in November. Further Spotlights will follow over the next year covering topics like Marketing Operations, Marketing Resources/Asset Management, Digital Content Management, Digital Experience, Customer Data Management, Digital Event Management.

Always keeping you informed! Peter

-

Marketing Event Management Report.

My new Vendor Selection Matrixtm research, this time on Marketing Event Management, has just been published by my business partner Research In Action. We had surveyed 1500 business decision-makers around the world on their preferences, challenges plus their opinions and ratings for the MEM vendors they know. Marketing Event Management (MEM) refers to a wide range of processes involved in the management of all customer events such as lead generation events, trade shows and conferences.

Traditionally a more tactical decision made by the event department, or corporate marketing, selecting a suitable MEM vendor will turn into one of the more strategic decisions for CMOs over the next year or so. During the COVID-19 crisis, the immediate goal was to cover an already-planned live event with an online alternative as a work-around and many executives made short-term decisions about the platform — optimization wasn’t yet part of their strategy, just getting it done. And event participants, and speakers, were so-easily pleased to be able to log in to any platform and be able to discuss business topics again.

Whether organizing an event or presenting at one, my personal experience during that time was that most of event platforms deployed were not purpose-built for virtual events; they were originally designed to provide other services—such as webinars, e-learning course management, or just event registration. In the last years, many MEM platform providers released new, dedicated software, to better support virtual events of all sizes; fueled, of course, by massive injections of venture capital into several of these vendors. However, not all vendors have noticed that the buying center has changed dramatically; from a project-oriented event manager to a team of much more strategic marketing executives.

The last years of business crisis increased the demand for digital tools and services for virtual customer meetings of all types: one-on-ones, team meetings, sales meetings, as well as larger marketing events. Virtual events replaced presence-based business conferences and trade shows, and customer meetings were facilitated on digital meeting platforms. With business travel now opened again, virtual is still a factor as other reasons such as cost control and sustainability considerations influence event-attendance decisions.

Here are the highlights of the survey……

- MEM is now more about Marketing than Events. When we asked about the top two priority investments in MEM, the buyers wanted more cost-efficient events first and foremost. However, after that comes scalability for large virtual events, video streaming capabilities and content experience as the next priorities. The latter two investment priorities reflect a significant change in the buying center for MEM software as it moves from being a project spend item to a more strategic investment. Event managers care about the event while marketers want to curate and offer their event content on an ongoing basis.

- Even after COVID, virtual is now standard in the new marketing event paradigm. Yes, in-person events are back, but they need to be more impactful and measurable than before. Digital marketers have now embedded the events calendar into their customer engagement programs; collecting market and customer insights at scale; maintaining a buyer/customer relationship over a longer period than just a buying cycle. But a hybrid event strategy will prevail, as buyers continue to be reluctant to travel, for reasons other than COVID (sustainability, cost, time). So, MEM must be a mix of on-site plus virtual attendance, but with attendees treated equally, with an event calendar of on-site and virtual events coordinated in a hub/spoke engagement strategy.

- The MEM market is under consolidation pressure. The global market for MEM software has moved from its previous boom economy, with businesses buying multiple MEM platforms to experiment with; to a consolidation state as companies now reduce their inventory of MEM vendor licenses to just a few strategic suppliers. Over half of the companies surveyed this year have more than 6 vendors they work with, counting all tools supporting virtual meetings, video conferencing, conferences and events, and trade shows. There has already been a significant consolidation of vendors in the past two years, with the proportion of firms with over 10 vendors reduced by two-thirds and the cohort with 6-10 vendors down 40%.

- Savvy marketers see Events as a feeder for a long-term on-demand video library. Realizing the long-term opportunity of the multitude of event recordings they are collecting, many marketing organizations want to create a branded content hub or corporate streaming platform. The recordings can then be leveraged into new campaigns or even just be discovered by web visitors– something like the Netflix or BBC iPlayer metaphor for their own content. Some are recruiting content producers with studio experience to be able to atomize many of the longer videos, ensuring consistency and relevance in marketing campaigns.

- The MEM vendor landscape bewilders, vendors must tell better stories. The over-100 MEM vendors have a variety of roots. Some have just repackaged traditional offerings through new product positioning. Others are meeting platforms that are good for that but not necessarily larger events, or vice-versa. Most are challenged, however, to communicate the benefits of their technologies to business-oriented marketers. MEM vendors are used to selling to event/project managers, or within IT/Telco departments, and many struggle to present their solutions to CMOs and their management team in marketing language and values.

The report provides a useful guide to important marketing event management market trends and names the Top Vendors as viewed by the market in 2023 (already a quite different landscape from 2021, as vendors drop out, confuse their branding, and/or consolidation takes its toll). As the report name suggests, these details will help buying teams make an informed decision regarding which vendors could best fit their requirements. I hope you enjoy reading it and reach out if you have questions. I did several in-depth interviews in addition to the survey research, so I know more than I wrote here.

I was particularly impressed with vendors BIZZABO, KALTURA, ON24, 6CONNEX, RAINFOCUS and SPOTME, all in the Market Leaders quadrant. These really understand the new needs of marketing executives around MEM and are providing solutions for those buyers.

Always keeping you informed! Peter

-

Marketing Event Management is now more about Marketing than Events.

Planning a marketing event calendar for the next year is probably going to be one of the more strategic programmes for many B2B CMOs and marketing directors over the next months. Many in marketing used to see events as nice-to-have vanity driven exercises of corporate PR. Now, for most, it is an integral part of an overall customer engagement strategy.

In the era of digital marketing, marketing plans include both physical and digital events as standard in customer engagement programs; to collect market/customer insights at scale and to maintain a buyer/customer relationship over a longer period than just a buying cycle. A B2B CMO I’ve met recently talked about plans as more of a ‘media strategy’ than a marketing strategy. Furthermore, I know of several large tech vendors that already have concrete plans into 2024 for large scale, multi-media, highly branded events accommodating thousands of delegates and providing an outstanding conference, networking and banqueting experience for business partners and customers alike.

Virtual marketing events will become part of a new marketing channel, scheduled, and atomised across the whole calendar and much more numerous, impactful, and measurable than before. Savvy marketing organizations will even augment that with an on-demand microsite using something like the Netflix or BBC iPlayer metaphor for their own content.

Marketing Event Management (MEM) refers to a wide range of processes involved in the management of all customer events such as lead generation events, trade shows and conferences. MEM software solutions help enhance the quality of virtual and physical events and meetings, as well as providing enhanced management visibility for the event organizers. The applications can streamline the planning, scheduling, and overall event organization.

The global market for MEM software has moved from its previous boom economy, with businesses buying multiple MEM platforms to experiment with; to a consolidation state as companies now reduce their inventory of MEM vendor licenses to just a few strategic suppliers. Over half of the companies surveyed this year have more than 6 vendors they work with, counting all tools supporting virtual meetings, video conferencing, conferences and events, and trade shows. There has already been a significant consolidation of vendors in the past two years, with the proportion of firms with over 10 vendors reduced by two-thirds and the cohort with 6-10 vendors down 40%.

Which means that my new Vendor Selection Matrixtm research on MEM, to be published next week, is going to be more useful than ever for potential buyers of software for that process. As usual, as the report reflects the view of the market, 1500 business decision-makers reported their opinions and ratings for the MEM vendors they know. That is quite different than the standard research reports from my old colleagues (remember, I am ex- Gartner and ex-Forrester) that focus on an analyst’s rating of the product, based on briefing presentations by the vendors invited to speak with them.

Here is a list of the Top 15 vendors as selected by the 1,500 users we surveyed, based upon their rating of product, company, and service quality (listed alphabetically): BIZZABO*, CADMIUMCD*, CERTAIN*, CIRCA, CVENT*, HUBB, KALTURA*, MEETYOO*, NOTIFIED, ON24*, RAINFOCUS*, 6CONNEX*, SPLASH*, SPOTME*, and ZOOM. These vendors* are the Market Leaders as they scored over 4 out of 5 in both the Strategy and Execution categories.

Always keeping you informed! Peter O’Neill

-

Identifying DX vendors is a challenge.

The last years has seen businesses in every sector accelerating their digital transformation plans in response to a customer base that clearly prefers to interact and buy digitally. This increased investment in digital transformation projects invariably results in a Digital Experience Management (DXM) project; either to replace the existing DXM or Web Content Management platform, or to consolidate the same across the company.

Modern DXM systems must support the delivery of compelling experiences across the whole customer journey, with real-time retrieval even needed for resource-intense media assets like video, even virtual reality (VR), and augmented reality (AR) images. The global market for DXM software and projects is therefore very healthy as companies replace their current older systems to ensure success in their digital marketing and digital selling.

Out of curiosity, I went through the 36 Martechstack examples published by Scott Brinker the other week and found these vendors named by various marketing organizations in their DXM (or similar) stacks.

- 6Sense listed under “Digital Experience” PathFactory, Mutiny, Wisia, and WordPress.

- Akamai has Adobe, Drift, Siteimprove, SDL, and Swiftype.

- IBM names Adobe, Brightedge, Contentful, Clearscope, and WordPress.

- Merkle lists under “Experience” just Adobe, Meta, and Salesforce.

- Verizon has Adobe and Medallia.

Almost every marketing software vendor will claim some element of DXM, so there are potentially thousands of vendors with DXM solutions. For historical reasons, (the stuff is already installed), many companies have multiple digital experience solutions in their stacks. So, the greatest challenge for them is integration. Which means that my new Vendor Selection Matrixtm research on DXM, to be published this week, is going to be more useful than ever for potential buyers of software for that process.

As usual, as the report reflects the view of the market, 1500 business decision-makers reported their opinions and ratings for the DXM vendors they know. That is quite different than the standard research reports from my old colleagues (remember, I am ex- Gartner and ex-Forrester) that focus on an analyst’s rating of the product, based on briefing presentations by the vendors invited to speak with them. Indeed, Forrester managed to put Oracle, Salesforce and SAP into the leader category in their report, though these vendors are hardly mentioned in other surveys, including our’s below.

The survey respondents named several priorities for DXM projects with #1 being system performance (meaning responsiveness) followed by customer experience. A new priority this year was advanced analytics and recommendation engines. On a global basis, 76% of the respondents told us they were consolidating numerous and disparate DXM systems; two years ago this share was 68%. 49% of those respondents cite “Achieving a 360-degree view of the customer” as their top reason for the consolidation.

These are the Top 15 vendors as selected by 1,500 users surveyed based upon their rating of product, company, and service quality (listed alphabetically): ACQUIA*, ADOBE*, BLOOMREACH*, CONTENTFUL*, COREMEDIA*, CROWNPEAK*, IBEXA, KENTICO, LIFERAY, MAGNOLIA*, OPENTEXT*, OPTIMIZELY*, ORACLE*, SITECORE, and SQUIZ*. These vendors* are the Market Leaders as they scored over 4 out of 5 in both the Strategy and Execution categories.

Always keeping you informed! Peter O’Neill

-

DAM no longer back-office

Continuing my predictions for 2023, here are two further propositions focused on the more mundane topic of Digital Asset Management (DAM):

- Modern DAM administrators are no longer just assets managers, they are supporting the delivery of compelling experiences across the whole customer journey.

- The DAM is a cornerstone of digital marketing. Which means that the DAM process is now a high priority for the whole marketing organization.

DAM did used to be a backroom process that most marketers do not concern themselves with directly and cynics would say, “A DAM is where our creative assets are sent to die” – it was, historically, just a repository for photographs and other static images. And the people managing it were the ultimate geeks. But things have changed.

Which means that my new Vendor Selection Matrixtm research on DAM is going to be more useful than ever for potential buyers of that software. DAM software is being bought in three separate project categories:

- Stand-alone DAM is being bought to replace one or more older-generation systems with a more performant and extensive solution. Indeed, 74% of the respondents to our survey are consolidating their DAM, PIM (Product Information System) and other content management systems this year.

- More mature marketing organizations who want to personalize the offerings they render to website visitors as much as possible find they must replace their DAM to achieve their goals.

- Companies in industries most affected by the new demands of digital marketing, eCommerce, and customer preference systems, such as manufacturing, healthcare and business services must upgrade their DAM systems accordingly as part of a larger project.

As usual, as the report reflects the view of the market, 1500 business decision-makers reported their opinions and ratings for the DAM vendors they know. That is quite different than the standard research reports from my old colleagues (remember, I am ex- Gartner and ex-Forrester) that focus on an analyst’s rating of the product. Buyers much prefer to hear what their peers are saying about a solution, I would suggest.

Depending on how much you believe the claims, there are nearly 500 vendors with DAM solutions. These are the Top 15 vendors as selected by 1,500 users surveyed based upon their rating of product, company, and service quality (listed alphabetically): ADOBE*, APRIMO*, BRANDMAKER (now called UPTEMPO), BYNDER*, CANTO, CELUM, CENSHARE*, CLOUDINARY*, CONTENTSERV, DIGIZUITE, HYLAND, NUXEO, OPENTEXT, SITECORE and WIDEN (part of ACQUIA). These vendors* form the Top 5 in the matrix.

The vendor landscape is stable with several well-established independent DAM vendors now being challenged by the expanded sales efforts of enterprise software vendors like Adobe, Sitecore, and OpenText who sell larger digital marketing software portfolios including a DAM solution. We estimate that 35-40% of companies have automated, or will be automating, parts of the DAM process in 2023.

The link above connects you to the public version of the report, with the alphabetical list of market leaders and shorter vendor profiles. Watch out for several versions of report in full detail over the next months as several vendors distribute their licensed reprints.

Always keeping you informed! Peter O’Neill

-

Buyers look for more than DAM

Just a few more days to go before I publish our Vendor Selection Matrixtm on Digital Asset Management (DAM)– the vendors are currently fact-checking the report details.

This year’s survey has made one point absolutely clear: modern DAM systems must support the delivery of compelling experiences across the whole customer journey, with real-time retrieval even needed for resource-intense media assets like video, even virtual reality (VR), and augmented reality (AR) images. Over 55% of the 1500 business professionals we talked to confirmed “We are now very focused on optimizing the customer experience and this requires change in the DAM process” as Very True.

We also asked, “Which three key anticipated benefits are driving your investment in the Digital Asset Management automation space in the next 12 months?”. After Improved Performance, the respondents chose Brand Management, Customer Experience and Improved Buyer Engagement as the next priorities. This reflects the strategic value of the DAM system within the new digital marketing standards expected in most companies.

Customers no longer need DAM, they crave for great DAM!

This is quite different from the same survey 3 years ago. Now, three times as many respondents see DAM in the wider context of “the entire buyer journey” (website, marketing content, sales content, etc.).

Also, 74% of the respondents confirmed that they want to consolidate their DAM systems. The top two reasons being “We need a single-source-of-truth” and “Achieving cost reduction”. But these priorities vary greatly by region – the Single Source reason is rated highest in North America (62%) while Cost Reduction is Europe’s top reason (61%).

DAM is a busy market, with many local project-based providers offering their experience as a software product. Indeed, the Capterra website lists 479 DAM vendors in its directory. We have found a vendor landscape of the Top 15 vendors and/or brands as selected by 1,500 business decision-makers, based upon their experience, or perception, of product, company and service quality.

These are the Market Leaders within the Top 15 (having both a Strategy and an Execution score of over 4 out of 5) as scored by the survey and myself (listed alphabetically): ACQUIA (WIDEN), ADOBE, APRIMO, BRANDMAKER, BYNDER, CANTO, CELUM, CENSHARE, CLOUDINARY, and OPENTEXT.

Watch out for the report in a few weeks’ time.

Always keeping you informed! Peter

-

Can’t Digitally Market without Great Digital Asset Management

I am working on an update to our Vendor Selection Matrixtm on Digital Asset Management (DAM) – the survey results are in and I’m now talking to the vendors named and scored in the survey over the next weeks before completing the report. The link above shows the 2021 report, and the list of vendors is quite consistent, just three out and three new ones in.

DAM is a backroom process that most marketers do not concern themselves with. Cynics used to say, “A DAM is where our creative assets are sent to die”. That is because, historically, it was a repository for photographs and other static images. And the people managing this process were the ultimate geeks. I well remember getting a client inquiry two weeks after I had made a speech at a Content Management Summit in Cleveland about getting more creative about tagging content assets with informative units like sales phase, customer pain point and other stuff. The client said that what I was proposing was impossible, he had tried and “my DAM coordinator told me “No way”, he uses the date and time stamp and that is all”.

But things have changed. Now modern DAM administrators know they are no longer just storing assets, they are supporting the delivery of compelling experiences across the whole customer journey. DAM systems are being used to store and manage rich media assets like video, even virtual reality (VR), and augmented reality (AR) images, as well as text and documents. DAM is a cornerstone of digital marketing, just like Digital Experience Management (my next report project, survey is in the field).

Which means that the DAM process is now a high priority for the whole marketing organization. This was confirmed in our survey of 1500 business professionals familiar with their DAM projects where 55% confirmed “We are now very focused on optimizing the customer experience and this requires change in the DAM process” as Very True.

The survey scored these three objectives as their top benefits desired from their DAM system:

- Better system performance and responsiveness

- Brand management capabilities

- Delivering an elegant and intuitive customer experience.

Nearly three quarters of the companies confirmed they were planning to consolidate their DAM, PIM, and other content management systems (up from 51% in 2021). So, this is an exciting (or precarious?) time for the DAM vendors, an interesting mix of marketing suite and point solution vendors.

Watch out for the report in a few weeks’ time.

Always keeping you informed! Peter

-

Propensity to Switch Vendors

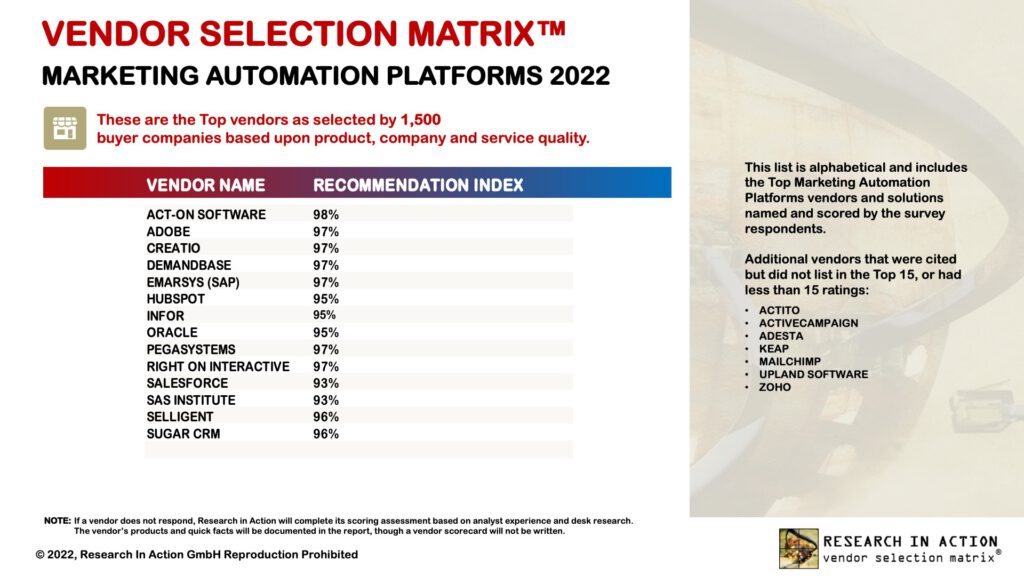

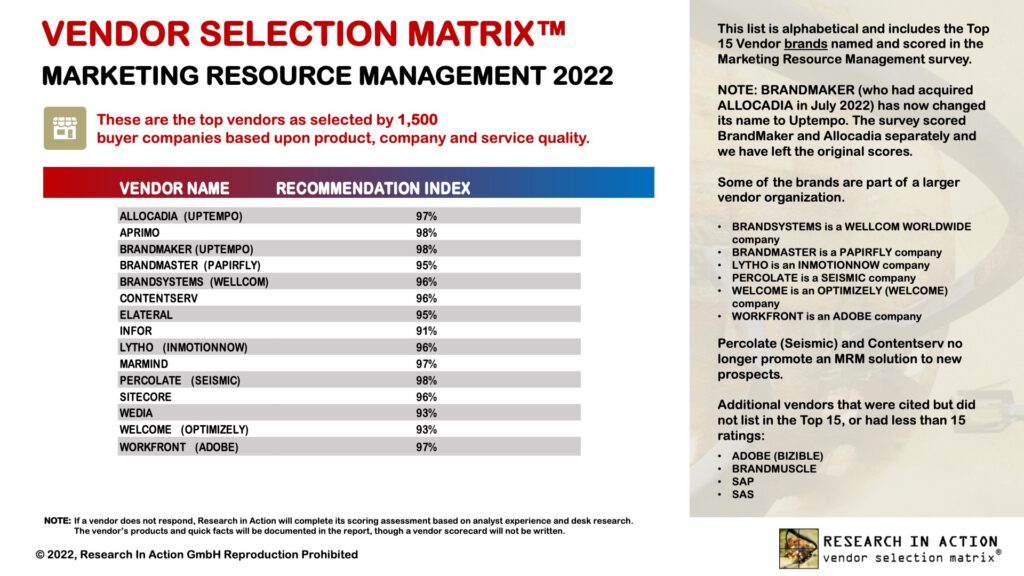

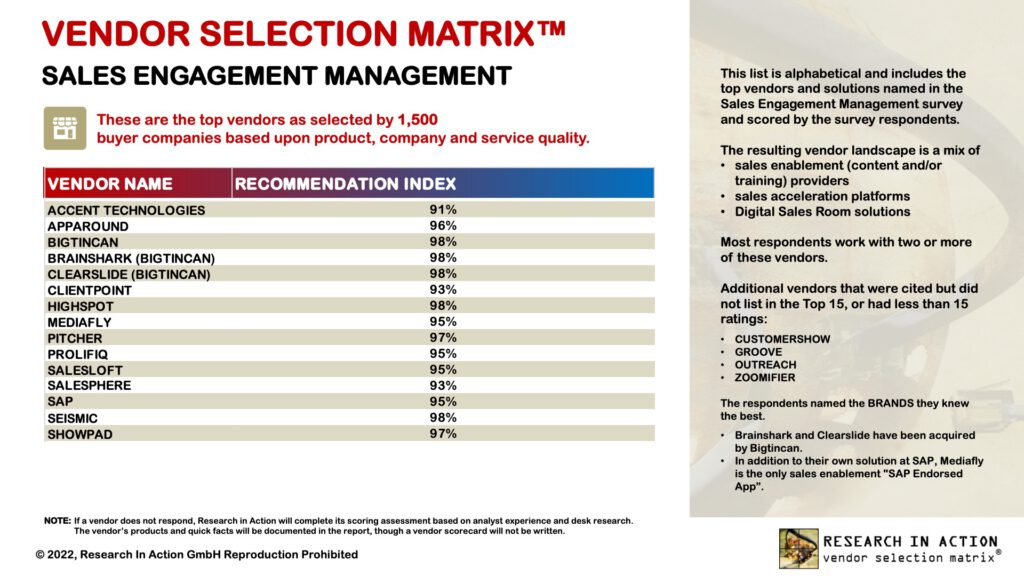

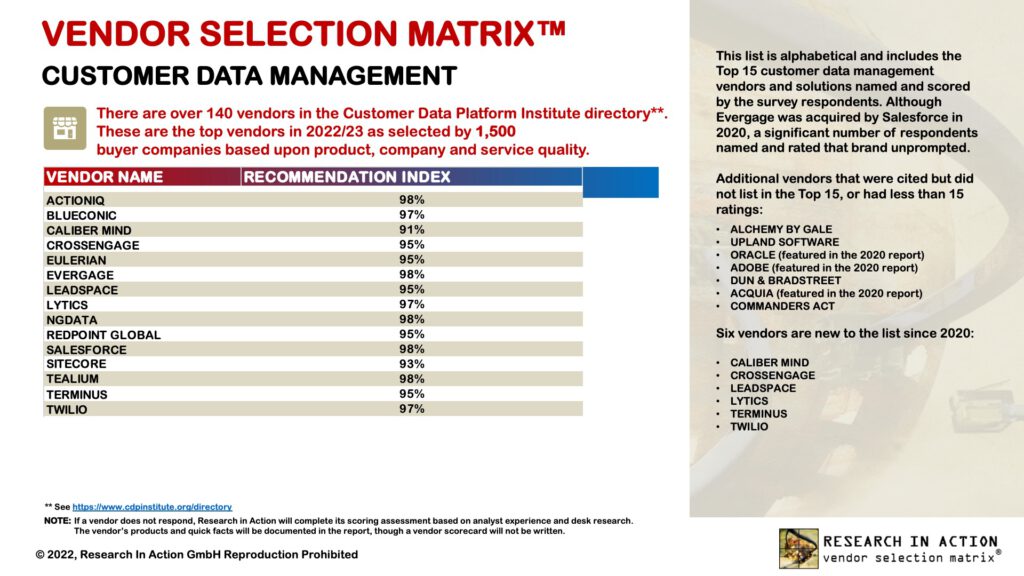

This year, I have collected several new Recommendation Index (RI) values from the Vendor Selection MatrixTM reports we have published. I see the RI as a significant leading indicator of long-term customer satisfaction but also, more importantly, of the propensity to switch indicated by customers. It is for that reason that we have included the points earned through the RI score in our Strategy axis on the matrix and give it a significant 25% weighting.

In our surveys, we actually ask about two items directly related to customer retention: the current satisfaction, and the “would you recommend this vendor?” question. Customer satisfaction is defined as a measurement that determines how happy customers are right now with the solution being evaluated and flows into the Execution axis of the matrix. The RI (the simple percentage of respondents who answer “yes”) encapsulates a longer- term, more strategic element of customer satisfaction – essentially it is a measurement of customer loyalty.

Vendors. I think that any RI 95% or over is satisfactory but an RI twixt 90 and 94% should raise some alarm signals about your customers’ emerging propensity to switch, while below 90% is already a state of alarm.

Buyers. You should interpret the numbers in a similar manner.

The data below shows that the vendors listed in our Marketing Automation Platforms (MAP) landscape include several that should feel threatened by a propensity to switch. Our survey also showed that 49% of the respondents were planning to replace their MAP with something more suitable while another 24% said that was under consideration – always a moment of truth for a supplier if your client is not really satisfied with their overall experience. And remember, these are the 15 or so vendors with the top scores – there are many others with lower numbers.

The next survey in 2022 was around Marketing Resource Management (MRM). Again, there are some vendors that should feel threatened by a propensity to switch.

We have also published our report on the top Sales Engagement Management (SEM) vendors as rated by our global survey of 1,500 practitioners. There is already a lot of churn in this market as businesses race to replace their older SEM platforms with a more capable and holistic solutions for more digital selling and marketing. However, there were not that many vendors at 94% or below.

This month we published our report on Customer Data Management. The table shows an impressive scoring of all Recommendation Index values in the high 90s with just two below the 95% number that I would set as an alert.

Overall, the numbers are good for these leading vendors. We’ll see how this analysis progresses in the 2023 surveys we have planned.

Always keeping you informed! Peter

-

Customer Data is Problem #1

Everybody is making predictions for the next year. Well, I see two certainties in marketing organizations for 2023.

- In response to both the recession and overspending over the last years, most marketing execs. will be culling their martech spend by shrinking user licenses and even cancelling some point solutions altogether.

- The one area they will NOT hold back spending is on Customer Data Management.

Marketing and sales professionals alike are saying inaccurate customer data is the biggest impediment to succeeding with data-driven marketing. According to a recent survey among 600 sales and marketing decision-makers in B2B or B2B-B2C hybrid firms by Dun & Bradstreet, some 34% of respondents cite accuracy of customer data as an obstacle to succeeding with data-driven marketing, and 30% cite the cost of third party data and lack of analytic capabilities as obstacles.

Which means that my new Vendor Selection Matrixtm research on Customer Data Management (CDM) is going to be more useful than ever for potential buyers of CDM software. Especially as the report reflects the view of the market, 1500 business decision-makers reported their opinions and ratings for the CDM vendors they know. That is quite different than the standard research reports from my old colleagues (remember, I am ex- Gartner and ex-Forrester) that focus on an analyst’s rating of the product. Buyers much prefer to hear what their peers are saying about a solution, I would suggest.

Depending on how much you believe the claims, there are over 140 vendors with CDM solutions, often calling their software Customer Data Platforms (CDP). The vendor landscape is actually quite stable with several well-established independent CDP vendors out there. These are now being challenged not only by the expanded sales efforts of enterprise software vendors like Salesforce, Adobe, and Oracle, but also through increased competition from tools that enable in-house IT teams to build their own CDP equivalent. We estimate that 40-45% of companies have automated, or will be automating, parts of the CDM process in 2022.

Providing an optimal customer experience is impossible without having a unified Customer Data Management (CDM) process in place: a process that includes the consolidation and aggregation of all data collected in separate systems across the company. This is not an IT-centric data warehouse or data lakes approach, ideally it should be a Marketing-led CDM initiative, helping to ensure the data unification project is focused directly on marketing requirements.

These are the 11 vendors that qualified as Market Leader (having both a Strategy and an Execution score of over 4 out of 5) in the Vendor Selection Matrix™ – Customer Data Management 2022 due to their scores in the survey and me (listed alphabetically):

ACTIONIQ, BLUECONIC, CROSSENGAGE, EULERIAN, EVERGAGE, LYTICS, NGDATA, REDPOINT GLOBAL, SALESFORCE, TEALIUM, and TWILIO

These are the vendor brands named spontaneously by the survey respondents. Some of the brands are part of larger vendor organizations (such as Evergage being part of Salesforce).

The overall Global Leader, as they were in the 2020 report, was Tealium.

The link above connects you to the public version of the report, with the alphabetical list of market leaders and shorter vendor profiles. Watch out for several versions of report in full detail over the next months as several vendors distribute their licensed reprints.

Always keeping you informed! Peter O’Neill