-

Propensity to Switch Vendors

This year, I have collected several new Recommendation Index (RI) values from the Vendor Selection MatrixTM reports we have published. I see the RI as a significant leading indicator of long-term customer satisfaction but also, more importantly, of the propensity to switch indicated by customers. It is for that reason that we have included the points earned through the RI score in our Strategy axis on the matrix and give it a significant 25% weighting.

In our surveys, we actually ask about two items directly related to customer retention: the current satisfaction, and the “would you recommend this vendor?” question. Customer satisfaction is defined as a measurement that determines how happy customers are right now with the solution being evaluated and flows into the Execution axis of the matrix. The RI (the simple percentage of respondents who answer “yes”) encapsulates a longer- term, more strategic element of customer satisfaction – essentially it is a measurement of customer loyalty.

Vendors. I think that any RI 95% or over is satisfactory but an RI twixt 90 and 94% should raise some alarm signals about your customers’ emerging propensity to switch, while below 90% is already a state of alarm.

Buyers. You should interpret the numbers in a similar manner.

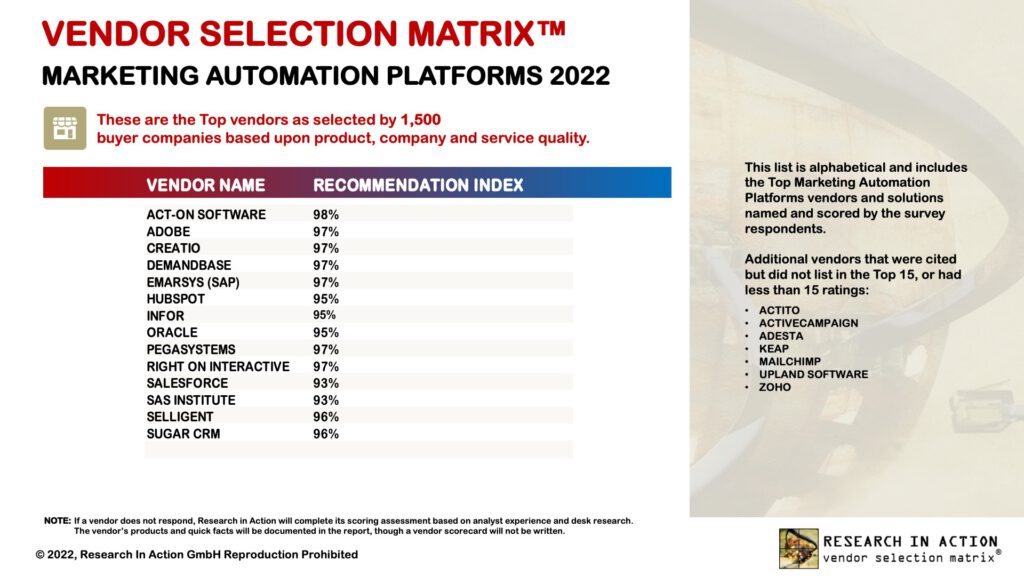

The data below shows that the vendors listed in our Marketing Automation Platforms (MAP) landscape include several that should feel threatened by a propensity to switch. Our survey also showed that 49% of the respondents were planning to replace their MAP with something more suitable while another 24% said that was under consideration – always a moment of truth for a supplier if your client is not really satisfied with their overall experience. And remember, these are the 15 or so vendors with the top scores – there are many others with lower numbers.

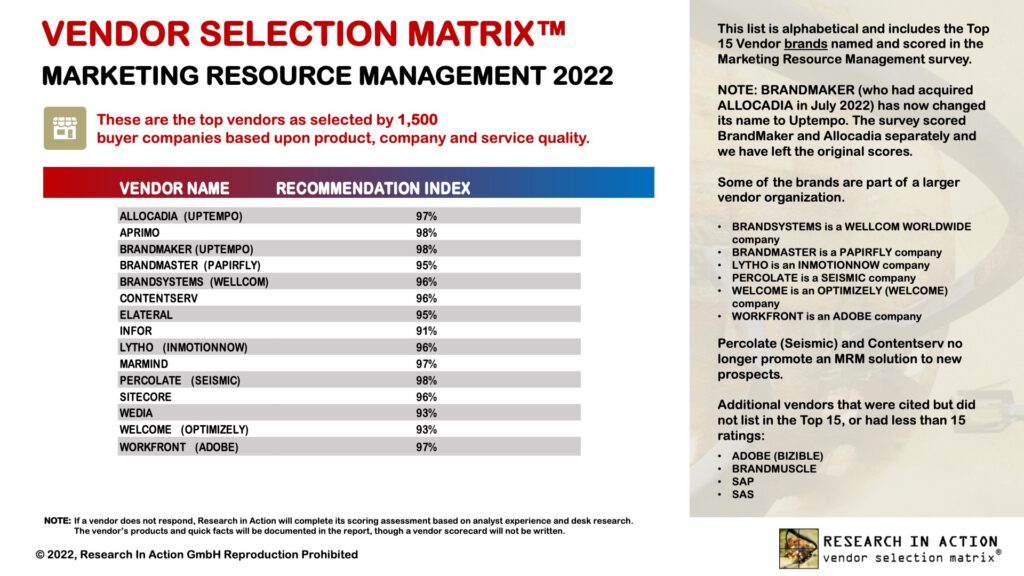

The next survey in 2022 was around Marketing Resource Management (MRM). Again, there are some vendors that should feel threatened by a propensity to switch.

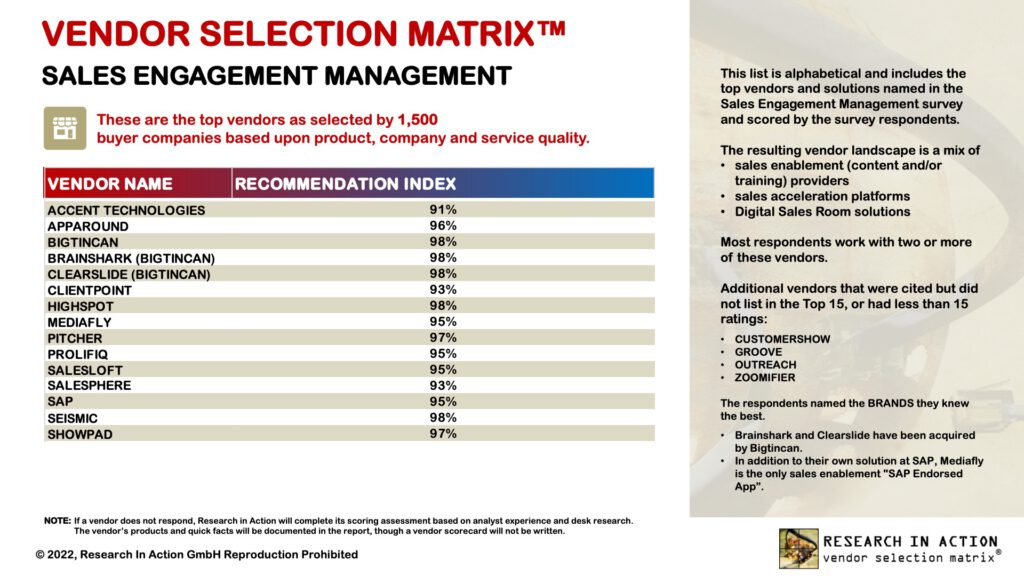

We have also published our report on the top Sales Engagement Management (SEM) vendors as rated by our global survey of 1,500 practitioners. There is already a lot of churn in this market as businesses race to replace their older SEM platforms with a more capable and holistic solutions for more digital selling and marketing. However, there were not that many vendors at 94% or below.

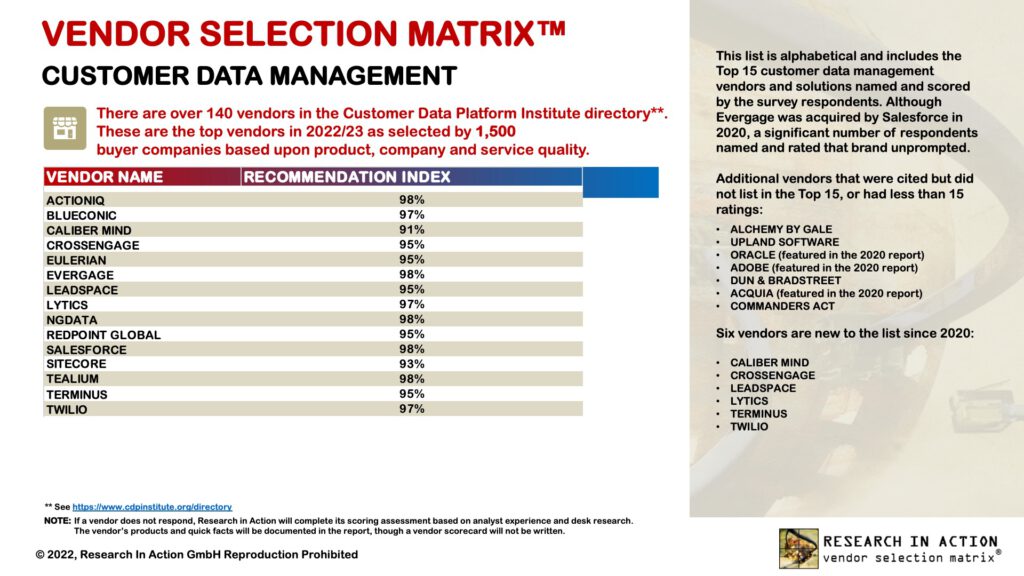

This month we published our report on Customer Data Management. The table shows an impressive scoring of all Recommendation Index values in the high 90s with just two below the 95% number that I would set as an alert.

Overall, the numbers are good for these leading vendors. We’ll see how this analysis progresses in the 2023 surveys we have planned.

Always keeping you informed! Peter

-

Customer Data is Problem #1

Everybody is making predictions for the next year. Well, I see two certainties in marketing organizations for 2023.

- In response to both the recession and overspending over the last years, most marketing execs. will be culling their martech spend by shrinking user licenses and even cancelling some point solutions altogether.

- The one area they will NOT hold back spending is on Customer Data Management.

Marketing and sales professionals alike are saying inaccurate customer data is the biggest impediment to succeeding with data-driven marketing. According to a recent survey among 600 sales and marketing decision-makers in B2B or B2B-B2C hybrid firms by Dun & Bradstreet, some 34% of respondents cite accuracy of customer data as an obstacle to succeeding with data-driven marketing, and 30% cite the cost of third party data and lack of analytic capabilities as obstacles.

Which means that my new Vendor Selection Matrixtm research on Customer Data Management (CDM) is going to be more useful than ever for potential buyers of CDM software. Especially as the report reflects the view of the market, 1500 business decision-makers reported their opinions and ratings for the CDM vendors they know. That is quite different than the standard research reports from my old colleagues (remember, I am ex- Gartner and ex-Forrester) that focus on an analyst’s rating of the product. Buyers much prefer to hear what their peers are saying about a solution, I would suggest.

Depending on how much you believe the claims, there are over 140 vendors with CDM solutions, often calling their software Customer Data Platforms (CDP). The vendor landscape is actually quite stable with several well-established independent CDP vendors out there. These are now being challenged not only by the expanded sales efforts of enterprise software vendors like Salesforce, Adobe, and Oracle, but also through increased competition from tools that enable in-house IT teams to build their own CDP equivalent. We estimate that 40-45% of companies have automated, or will be automating, parts of the CDM process in 2022.

Providing an optimal customer experience is impossible without having a unified Customer Data Management (CDM) process in place: a process that includes the consolidation and aggregation of all data collected in separate systems across the company. This is not an IT-centric data warehouse or data lakes approach, ideally it should be a Marketing-led CDM initiative, helping to ensure the data unification project is focused directly on marketing requirements.

These are the 11 vendors that qualified as Market Leader (having both a Strategy and an Execution score of over 4 out of 5) in the Vendor Selection Matrix™ – Customer Data Management 2022 due to their scores in the survey and me (listed alphabetically):

ACTIONIQ, BLUECONIC, CROSSENGAGE, EULERIAN, EVERGAGE, LYTICS, NGDATA, REDPOINT GLOBAL, SALESFORCE, TEALIUM, and TWILIO

These are the vendor brands named spontaneously by the survey respondents. Some of the brands are part of larger vendor organizations (such as Evergage being part of Salesforce).

The overall Global Leader, as they were in the 2020 report, was Tealium.

The link above connects you to the public version of the report, with the alphabetical list of market leaders and shorter vendor profiles. Watch out for several versions of report in full detail over the next months as several vendors distribute their licensed reprints.

Always keeping you informed! Peter O’Neill