-

Marketing Event Management Report.

My new Vendor Selection Matrixtm research, this time on Marketing Event Management, has just been published by my business partner Research In Action. We had surveyed 1500 business decision-makers around the world on their preferences, challenges plus their opinions and ratings for the MEM vendors they know. Marketing Event Management (MEM) refers to a wide range of processes involved in the management of all customer events such as lead generation events, trade shows and conferences.

Traditionally a more tactical decision made by the event department, or corporate marketing, selecting a suitable MEM vendor will turn into one of the more strategic decisions for CMOs over the next year or so. During the COVID-19 crisis, the immediate goal was to cover an already-planned live event with an online alternative as a work-around and many executives made short-term decisions about the platform — optimization wasn’t yet part of their strategy, just getting it done. And event participants, and speakers, were so-easily pleased to be able to log in to any platform and be able to discuss business topics again.

Whether organizing an event or presenting at one, my personal experience during that time was that most of event platforms deployed were not purpose-built for virtual events; they were originally designed to provide other services—such as webinars, e-learning course management, or just event registration. In the last years, many MEM platform providers released new, dedicated software, to better support virtual events of all sizes; fueled, of course, by massive injections of venture capital into several of these vendors. However, not all vendors have noticed that the buying center has changed dramatically; from a project-oriented event manager to a team of much more strategic marketing executives.

The last years of business crisis increased the demand for digital tools and services for virtual customer meetings of all types: one-on-ones, team meetings, sales meetings, as well as larger marketing events. Virtual events replaced presence-based business conferences and trade shows, and customer meetings were facilitated on digital meeting platforms. With business travel now opened again, virtual is still a factor as other reasons such as cost control and sustainability considerations influence event-attendance decisions.

Here are the highlights of the survey……

- MEM is now more about Marketing than Events. When we asked about the top two priority investments in MEM, the buyers wanted more cost-efficient events first and foremost. However, after that comes scalability for large virtual events, video streaming capabilities and content experience as the next priorities. The latter two investment priorities reflect a significant change in the buying center for MEM software as it moves from being a project spend item to a more strategic investment. Event managers care about the event while marketers want to curate and offer their event content on an ongoing basis.

- Even after COVID, virtual is now standard in the new marketing event paradigm. Yes, in-person events are back, but they need to be more impactful and measurable than before. Digital marketers have now embedded the events calendar into their customer engagement programs; collecting market and customer insights at scale; maintaining a buyer/customer relationship over a longer period than just a buying cycle. But a hybrid event strategy will prevail, as buyers continue to be reluctant to travel, for reasons other than COVID (sustainability, cost, time). So, MEM must be a mix of on-site plus virtual attendance, but with attendees treated equally, with an event calendar of on-site and virtual events coordinated in a hub/spoke engagement strategy.

- The MEM market is under consolidation pressure. The global market for MEM software has moved from its previous boom economy, with businesses buying multiple MEM platforms to experiment with; to a consolidation state as companies now reduce their inventory of MEM vendor licenses to just a few strategic suppliers. Over half of the companies surveyed this year have more than 6 vendors they work with, counting all tools supporting virtual meetings, video conferencing, conferences and events, and trade shows. There has already been a significant consolidation of vendors in the past two years, with the proportion of firms with over 10 vendors reduced by two-thirds and the cohort with 6-10 vendors down 40%.

- Savvy marketers see Events as a feeder for a long-term on-demand video library. Realizing the long-term opportunity of the multitude of event recordings they are collecting, many marketing organizations want to create a branded content hub or corporate streaming platform. The recordings can then be leveraged into new campaigns or even just be discovered by web visitors– something like the Netflix or BBC iPlayer metaphor for their own content. Some are recruiting content producers with studio experience to be able to atomize many of the longer videos, ensuring consistency and relevance in marketing campaigns.

- The MEM vendor landscape bewilders, vendors must tell better stories. The over-100 MEM vendors have a variety of roots. Some have just repackaged traditional offerings through new product positioning. Others are meeting platforms that are good for that but not necessarily larger events, or vice-versa. Most are challenged, however, to communicate the benefits of their technologies to business-oriented marketers. MEM vendors are used to selling to event/project managers, or within IT/Telco departments, and many struggle to present their solutions to CMOs and their management team in marketing language and values.

The report provides a useful guide to important marketing event management market trends and names the Top Vendors as viewed by the market in 2023 (already a quite different landscape from 2021, as vendors drop out, confuse their branding, and/or consolidation takes its toll). As the report name suggests, these details will help buying teams make an informed decision regarding which vendors could best fit their requirements. I hope you enjoy reading it and reach out if you have questions. I did several in-depth interviews in addition to the survey research, so I know more than I wrote here.

I was particularly impressed with vendors BIZZABO, KALTURA, ON24, 6CONNEX, RAINFOCUS and SPOTME, all in the Market Leaders quadrant. These really understand the new needs of marketing executives around MEM and are providing solutions for those buyers.

Always keeping you informed! Peter

-

Propensity to Switch Vendors

This year, I have collected several new Recommendation Index (RI) values from the Vendor Selection MatrixTM reports we have published. I see the RI as a significant leading indicator of long-term customer satisfaction but also, more importantly, of the propensity to switch indicated by customers. It is for that reason that we have included the points earned through the RI score in our Strategy axis on the matrix and give it a significant 25% weighting.

In our surveys, we actually ask about two items directly related to customer retention: the current satisfaction, and the “would you recommend this vendor?” question. Customer satisfaction is defined as a measurement that determines how happy customers are right now with the solution being evaluated and flows into the Execution axis of the matrix. The RI (the simple percentage of respondents who answer “yes”) encapsulates a longer- term, more strategic element of customer satisfaction – essentially it is a measurement of customer loyalty.

Vendors. I think that any RI 95% or over is satisfactory but an RI twixt 90 and 94% should raise some alarm signals about your customers’ emerging propensity to switch, while below 90% is already a state of alarm.

Buyers. You should interpret the numbers in a similar manner.

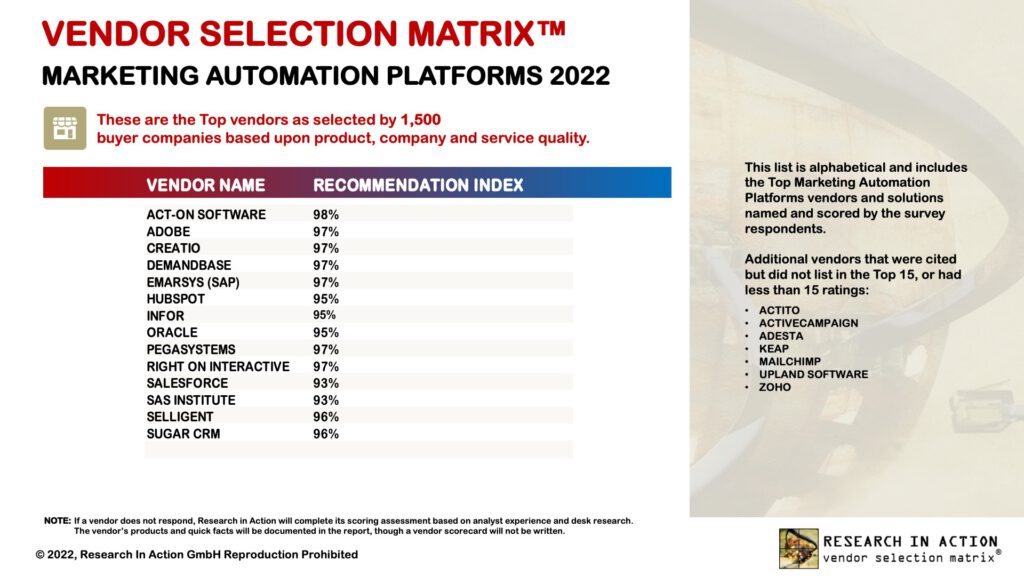

The data below shows that the vendors listed in our Marketing Automation Platforms (MAP) landscape include several that should feel threatened by a propensity to switch. Our survey also showed that 49% of the respondents were planning to replace their MAP with something more suitable while another 24% said that was under consideration – always a moment of truth for a supplier if your client is not really satisfied with their overall experience. And remember, these are the 15 or so vendors with the top scores – there are many others with lower numbers.

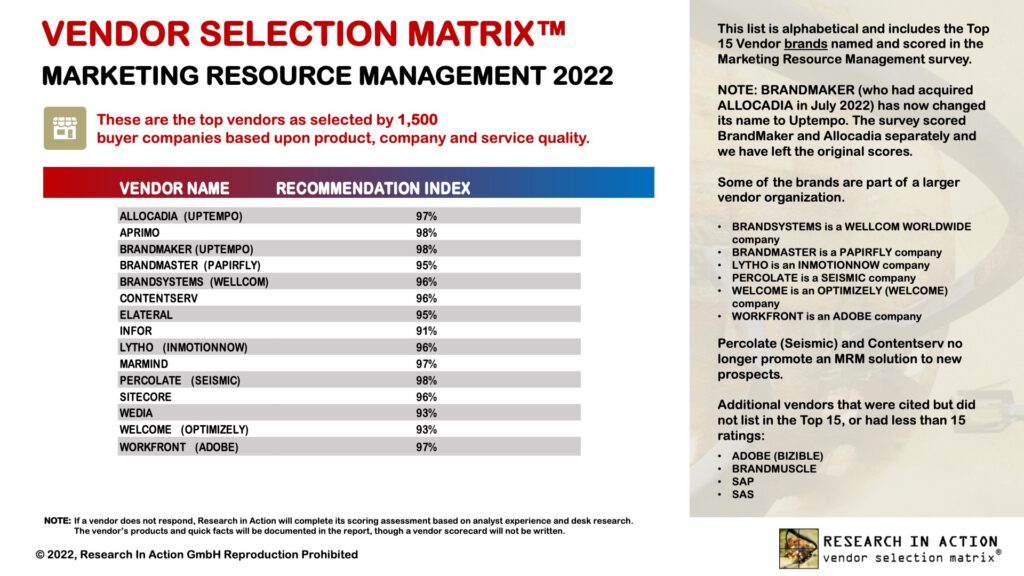

The next survey in 2022 was around Marketing Resource Management (MRM). Again, there are some vendors that should feel threatened by a propensity to switch.

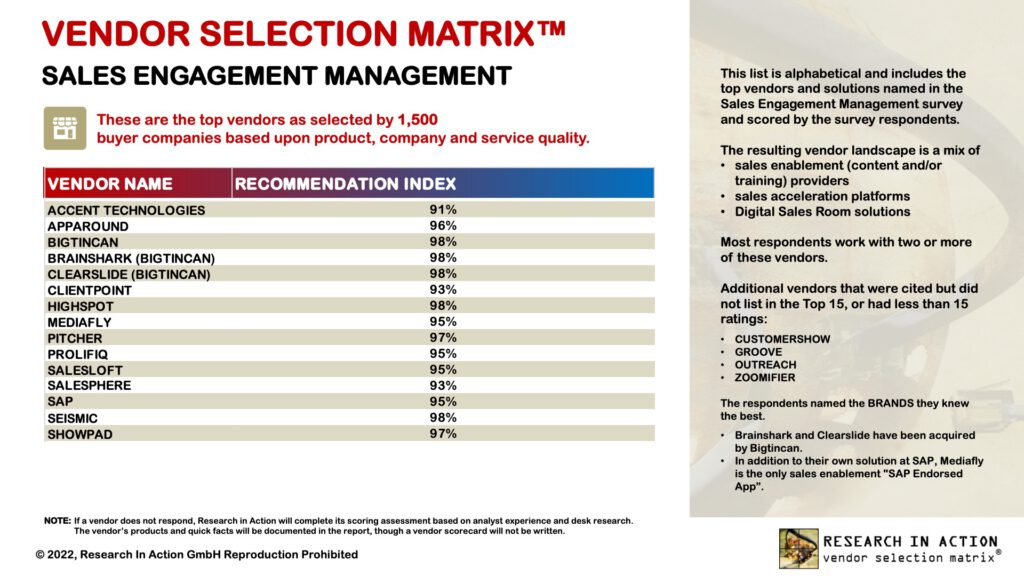

We have also published our report on the top Sales Engagement Management (SEM) vendors as rated by our global survey of 1,500 practitioners. There is already a lot of churn in this market as businesses race to replace their older SEM platforms with a more capable and holistic solutions for more digital selling and marketing. However, there were not that many vendors at 94% or below.

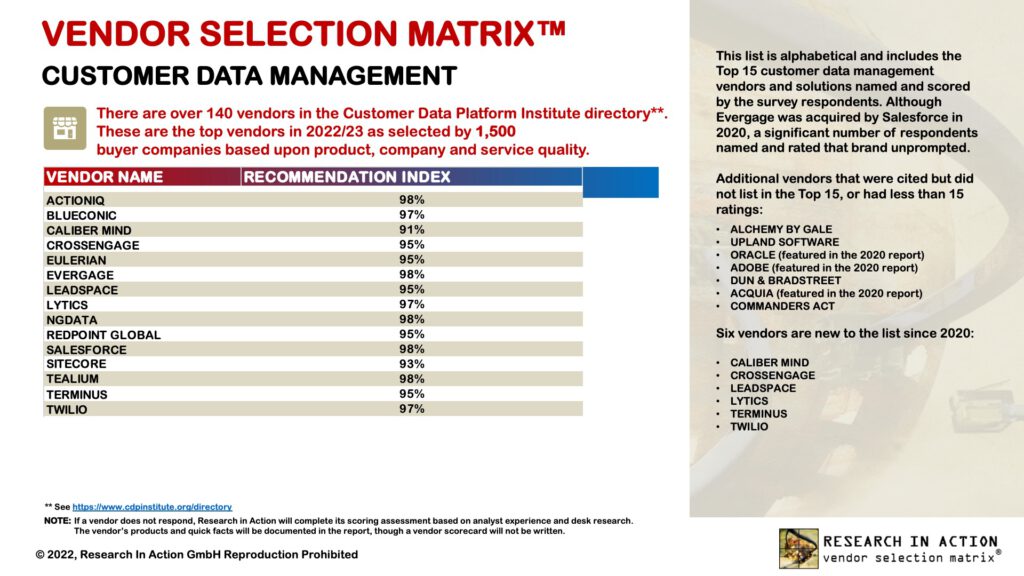

This month we published our report on Customer Data Management. The table shows an impressive scoring of all Recommendation Index values in the high 90s with just two below the 95% number that I would set as an alert.

Overall, the numbers are good for these leading vendors. We’ll see how this analysis progresses in the 2023 surveys we have planned.

Always keeping you informed! Peter

-

Customer Data is Problem #1

Everybody is making predictions for the next year. Well, I see two certainties in marketing organizations for 2023.

- In response to both the recession and overspending over the last years, most marketing execs. will be culling their martech spend by shrinking user licenses and even cancelling some point solutions altogether.

- The one area they will NOT hold back spending is on Customer Data Management.

Marketing and sales professionals alike are saying inaccurate customer data is the biggest impediment to succeeding with data-driven marketing. According to a recent survey among 600 sales and marketing decision-makers in B2B or B2B-B2C hybrid firms by Dun & Bradstreet, some 34% of respondents cite accuracy of customer data as an obstacle to succeeding with data-driven marketing, and 30% cite the cost of third party data and lack of analytic capabilities as obstacles.

Which means that my new Vendor Selection Matrixtm research on Customer Data Management (CDM) is going to be more useful than ever for potential buyers of CDM software. Especially as the report reflects the view of the market, 1500 business decision-makers reported their opinions and ratings for the CDM vendors they know. That is quite different than the standard research reports from my old colleagues (remember, I am ex- Gartner and ex-Forrester) that focus on an analyst’s rating of the product. Buyers much prefer to hear what their peers are saying about a solution, I would suggest.

Depending on how much you believe the claims, there are over 140 vendors with CDM solutions, often calling their software Customer Data Platforms (CDP). The vendor landscape is actually quite stable with several well-established independent CDP vendors out there. These are now being challenged not only by the expanded sales efforts of enterprise software vendors like Salesforce, Adobe, and Oracle, but also through increased competition from tools that enable in-house IT teams to build their own CDP equivalent. We estimate that 40-45% of companies have automated, or will be automating, parts of the CDM process in 2022.

Providing an optimal customer experience is impossible without having a unified Customer Data Management (CDM) process in place: a process that includes the consolidation and aggregation of all data collected in separate systems across the company. This is not an IT-centric data warehouse or data lakes approach, ideally it should be a Marketing-led CDM initiative, helping to ensure the data unification project is focused directly on marketing requirements.

These are the 11 vendors that qualified as Market Leader (having both a Strategy and an Execution score of over 4 out of 5) in the Vendor Selection Matrix™ – Customer Data Management 2022 due to their scores in the survey and me (listed alphabetically):

ACTIONIQ, BLUECONIC, CROSSENGAGE, EULERIAN, EVERGAGE, LYTICS, NGDATA, REDPOINT GLOBAL, SALESFORCE, TEALIUM, and TWILIO

These are the vendor brands named spontaneously by the survey respondents. Some of the brands are part of larger vendor organizations (such as Evergage being part of Salesforce).

The overall Global Leader, as they were in the 2020 report, was Tealium.

The link above connects you to the public version of the report, with the alphabetical list of market leaders and shorter vendor profiles. Watch out for several versions of report in full detail over the next months as several vendors distribute their licensed reprints.

Always keeping you informed! Peter O’Neill

-

MRM Earns a Boost of Interest, but is About to Change

I hope you had a great summer break. I was away for a few weeks myself and have returned to my desk refreshed and ready for more work as Research Director for Research In Action, Lead Analyst at B2B Marketing, as well as several individual client projects.

Earlier this month, I completed my 2022 Vendor Selection Matrix research on Marketing Resource Management and can report that there is clear increased interest in establishing a such a system to help marketing executives to plan, monitor, and control the usage of their most important resources: money, people, content assets, projects, and brand.

Marketing financials and calendars are the most popular processes being automated, closely followed by marketing performance management. Based on our conversations with users and vendors, we estimate that 55-60% of companies have automated, or will be automating, parts of the MRM process in 2022.

When we asked 1500 business professionals about their 2022 MRM projects, well-over one third of companies cited the need for data on marketing performance or return-on-investment as their major reason for MRM investment. Just over one third see it as a method to reduce overall costs and a significant 26% consider improved brand management as a priority.

The need for such a Marketing Resource Management process was proposed some years ago (I could probably claim to be that analyst) but not readily accepted by the user community. Now, the need for MRM is perhaps clearer, but the modern marketing executive wants more than just an asset management system.

They need a more dynamic solution that enables them to forecast, measure, model, analyze and even predict all their business numbers – to be fully empowered with control over their marketing processes and outcomes.

I anticipate the process name itself to mature in the next years. It will be interesting to see what thought leadership campaigns come out of the vendors and how quickly the user community can tune in to the new terminology.

These are the Market Leaders (having both a Strategy and an Execution score of over 4 out of 5) in the Vendor Selection Matrix™ – Marketing Resource Management 2022 as scored by the survey and myself (listed alphabetically):

ALLOCADIA, APRIMO, BRANDMAKER, BRANDSYSTEMS, CONTENTSERV, LYTHO, MARMIND, PERCOLATE, SITECORE, WEDIA, OPTIMIZELY (WELCOME), and WORKFRONT (ADOBE)

These are the vendor brands named spontaneously by the survey respondents. Some of the brands are part of larger vendor organizations (such as Welcome being part of Optimizely and Workfront part of Adobe). Also, BrandMaker acquired Allocadia earlier this year and have now rebranded completely to Uptempo.

Some of the marketers we surveyed saw MRM as just content or even digital asset management and so named and scored their vendors. Both Contentserv and Percolate (Seismic) have stated that they appreciate the great feedback from the survey but no longer promote their solution as an MRM solution and should be applauded for their honesty.

The link above connects you to the public version of the report, with the alphabetical list of market leaders and shorter vendor profiles. Watch out for several versions of report in full detail over the next months as several vendors distribute their licensed reprints.

Always keeping you informed! Peter

-

Marketers Need to Manage All Their Resources

You may have noticed: when I do market research on software vendors and products, I always approach my topics from the business point of view – not a technology category/label only familiar to product managers in software companies, or analysts at Gartner or Forrester. I name a business process (or family of processes) that I know marketers are thinking about. After all, marketing executives don’t buy software because they are collectors, they want to make their processes more efficient and expect an automation project will help.

Over the years, their list of processes to be automated has become longer but also more business centric. Way back when, marketing was only about sales support, lead generation and literature. Now, thankfully, modern CMOs or Marketing Directors are now responsible for a more extensive operation, some of them even measured on revenue contribution. And so, as with any business executive, they have full responsibility for the planning and effectiveness of all their business resources.

For a marketing executive, those resources fall into these categories: money, people, content assets and brand. And the process to manage these resources is therefore being called “Marketing Resource Management” (MRM).

I would propose that now the time has come for many more CMOs and Marketing Directors to acquire their own “ERP system” and implement a serious MRM project, taking full control over what can make a marketing organization successful – especially the financials.

Content and brand resources are already marketing-specific and many CMS and Brand Content Management systems include resource management for those resource types. Digital assets are managed in DAM and PIM systems. But using the corporate ERP software to manage people resources is not good enough as a typical CMO-led organization increasingly includes external contributors (agencies, freelancers, analysts), all to be accounted for as an ongoing marketing-people resource. Lastly, the spending of marketing budgets is now so dynamic and digital that executives can no longer rely on monthly or quarterly batched financial reports with historical data – if anything, they need a dashboard that forecasts, predicts and recommends.

By definition, the MRM system should be marketing-centric – one that has the right language or terminology, reporting structure and cadence. Marketers think in terms of campaigns, not financial quarters, and they need a planning calendar. It should provide marketing professionals at all levels in the hierarchy with an ideal experience and support decisions about marketing investments. For that reason, the ideal solution would often be one that is grown out of an existing management system used within marketing.

But a relevant MRM must be more than just a planning/budgeting system: database plus reporting. It needs to able to be state of the art in that it can:

- Take inputs from all players in the marketing ecosystem – for many companies this can include geographic entities or subsidiaries and even business partners

- Collect live data in real-time to support decision-making

- Provide recommendations and insights based on AI.

MRM is still in its adoption infancy. Capterra has some 50 MRM Software offerings in its directory. And my esteemed ex-colleagues at Forrester produced a NowTech report on MRM in Q1 this year that focused on the needs of enterprise B2C organizations above $1 billion in revenue and identified 28 vendors.

But what is the market saying?

Well, I have now fielded my 2022 global survey of marketers’ experience with MRM solutions and am talking to the vendors to complete my research. This is the list of the Top 15 vendors from the survey (in alphabetical order).

ALLOCADIA, APRIMO, BRANDMAKER, BRANDMASTER, BRANDSYSTEMS, CONTENTSERV, ELATERAL, INFOR, LYTHO, MARMIND, PERCOLATE, SITECORE, WEDIA, WELCOME, WORKFRONT

Curiously, a significant number of vendors who marketers cite as their MRM solution are telling me that they do not want to “position the offering as MRM”. Who says that the customer is always right?

Always keeping you informed! Peter O’Neill

-

Design Thinking in The Vendor Selection Process

Many years ago, working at HP, I quickly learned to schedule my vacations according to the marketplace. Common practice was, when customers (well, prospects) went on their vacation, they first dumped some work on my colleagues and myself, sending us a thick envelope (no Email in those days) containing a “Request for Proposal” or even worse (sounds so uncommitted!) a “Request for Information” — long, detailed documents laying out a series of specifications and functions that they wanted to see in our product.

We’d be expected to process/answer many detailed questions and submit a response when they came back from vacation. Most RFPs were issued, especially here in Germany, during the summer and just before Christmas.

I got the impression that creating these RFP documents, and then processing the vendor replies, was the main event for many buyers. It wasn’t necessarily about picking the right solution. The later stages (presentation, demo, negotiation, sales) seemed to happen very quickly afterwards.

Further work experience also taught me that the famous adage that “70% of IT projects fail” is very true and continues to be so. I would suggest that one reason for this is the above process. Many companies assume that the most important component of any process automation project is the Vendor Selection Process (VSP). Once that’s done, it is easy sailing – just install it, configure it, (perhaps) train the users and run the system.

Well, I’ve now assisted many a client through their VSP and sat in on their meetings with potential suppliers to provide my input as “an outsider”. I trust that my assessment of the vendors’ offerings and potential to fit into their planned technical architecture was useful. But still, I’ve often left the meetings with the feeling that the client wasn’t really prepared for the full project. I would notice that many aspects of the project were not yet thought through. There were often:

- No sample business workflows (much of which is outside the software they’ll buy)

- No profile of their potential users (devices, competencies, preferences)

- No sample reports or dashboards designed

- No prioritization in their list of requirements – all was equally important.

Process automation projects fail because of a bad fit between project solution and requirements. And when I say “project” I mean much more than the software product. The solution must cover the complete business scenario to be improved, which is usually only partly through technology – process and organization always needs to be tuned as well.

I suggest that it is now time to reconsider the role of the VSP – it should not be “the means to an end” – better to turn it into the kick-off for a process transformation project.

In 2009, the Hasso Plattner Institute of Design at Stanford came up with the concept of “design thinking” which has been adopted by many IT organizations and software vendors as the basis for their development projects. The associated meeting/communications method, SCRUM, has now even been adopted by modern marketing departments. The Stanford School process proposes these steps in a project:

Empathize – Define – Ideate – Prototype – Test.

So here is what I envisage in a modern marketing process automation project:

Empathize. Collect and describe the requirements based not on technical specifications but by describing real business scenarios – improved workflows that marketers care about. Include persona profiles and the desired “usage tone” (marketing- or IT-centric, advanced or casual user, terminology known or not, device preferred, location of task, reporting requirements, millennials!). A scenario documentation should resemble the briefings given to marketing agencies – not an RFP spreadsheet.

Define. Based on the make-up of the user-team and other requirements such as integrations and services, you should be able to easily segment the vendors and arrive at a shortlist. Provide the scenario documentation to those vendors and gather their responses as a first selection phase. Allow them to be creative – they may even be able to propose process improvements that you had not yet identified.

Ideate. Invest time here to engage with three to five vendors to explore how they would help you to automate the scenarios. If you want to restrict this phase, limit how many scenarios each vendor works on – one will probably suffice for you to form an impression of the vendor’s suitability as a business partner.

Prototype. The people at Stanford would love you to be putting Post-It notes on the wall in this phase, but you should probably expect your vendors to be able to demonstrate how they would support your scenarios with their software. You should now be down to one or perhaps two vendors. As well as checking whether they have realistic expectations, also use this phase to observe how the project members will work together – vendor people with your colleagues but perhaps you are also bringing together colleagues who are strange to each other. Create a conflict situation by changing a scenario and see how all players react.

Test. After selecting your technology provider, you now move into the project roll-out phase, which is usually focused on just one team, location, or business area to generate success and then a more expansive roll-out. Continue to expect the vendor to treat you as a business partner and working to ensure your success.

The test phase should never end. Wise project managers will maintain a running, live doc of the business requirements, because they’ll change over time. Display it in a flexible and editable spot to allow you to constantly re-check what you need, and the costs associated with it. Also, ask yourself periodically what can you cut? Or what hasn’t been used in months? Who is now using the software – is that different than initially assumed?

Something to think about the next time you plan an automation project.

Always keeping you informed! Peter O’Neill

-

Some Background to my Vendor Research

If you are reading this, then I assume that you’ve looked at a couple of my Vendor Selection Matrixtm reports and are thinking … they look like magic quadrants or waves but they seem to be different… Well, they certainly are – in more ways than one !

I do this work with my business partner Research In Action and mine are written for marketing software buyers who need to automate one or more important marketing processes and are researching which vendors COULD provide the software their business will require for optimal functionality and strategy.

They’re likely to be calling the project something close to the process(es) being automated and improved, but there is no guarantee that the vendors will be using that terminology when describing their products.

I design my projects around the process name I think Marketers would use and survey businesses on their experience. Often, that collects a landscape of vendors using different technology labels but that is the reality.

All in all, there is a multitude of vendor report types out there. On one end of the spectrum, you have the Analyst Reports with industry analyst expertise and in-depth research. On the other end, we have Crowd-Sourced Reports in which rankings are driven by the quality and quantity of user reviews.

Analyst Reports

Pros: The “Tier One” industry analysts doing this work are experts in their field and seriously know their stuff. They sit through strategy and product presentations/demos and some even get feedback from referenced customers. Vendors must invest days of time and resources to provide the right information to the analyst. Of course, many also sign up as clients and engage with the analyst on an ongoing basis to optimize the relationship.

Spoiler Alert: In my time as Research Director at Forrester, I had an analyst in my team who consulted specifically on how to execute the process of Analyst Relations (it’s part of B2B Marketing after all) – including how to get yourself placed in an optimal position in a quadrant or wave analysis.

Cons: The Analyst Report is written for the research firm’s clients, usually large enterprises – which influences the list of vendors include, of course. These are smaller audiences than is often assumed. Usually, the readership of each report behind their paywall is perhaps in the hundreds – one vendor client told me that the latest two reports where his product was featured had 480 and just 58 views on the research website.

That can be a little depressing not only for the vendor but also for the analyst – all that work and so little attention! Of course, the brand power, and resulting product-marketing ego, of being in a “Magic Quadrant” or “Forrester Wave” means that some vendors buy reprint-licenses and offer a download of the report through their website. And they book the analyst to make speeches/webinars about the research – a little show business that compensates for the initial disappointment perhaps.

Crowd-Sourced Reports

Pros: It’s always helpful to seek out feedback from other users; peers who share the good, bad, and the ugly about a product. There are several such feedback websites now up and running for all types of software applications, including marketing.

Cons: Have you ever looked up your favourite restaurant on Yelp, noticed a few one-star reviews, and wondered how they could come to such contrasting conclusions? A single review (good or bad) shouldn’t dictate your software-buying decision, just like with any other product. Remember: User opinions have varying levels of actual marketing automation understanding – just because someone writes a review does not make them an expert in the field.

Additionally, report rankings are driven by the quality and quantity of user reviews. If a company has a few hundred reviews with a high rating average, and another has a few thousand reviews with above-average ratings, it is likely the latter will position better in the report due to the sheer number of reviews. This is a huge advantage for larger vendors that have been on the market for a long time, and it’s likely they have review incentive programs to boost their ranking.

Research In Action Reports Have Both Perspectives

The methodology at Research In Action is that we first survey 1,500 practitioners about THEIR view of automating the process(es) in questions. And then we ask them to name one or two vendors they associate with the project and give us feedback on the vendor’s product, service, value-for-money, and ability to innovate. The vendors who score highly enough in the survey get into the Vendor Selection Matrixtm report in the first place (usually 15 to 20 vendors).

Then, that curated market feedback is seasoned with a touch of industry analyst’s (that’s me) expertise to provide a more well-rounded recipe for successful vendor selection. In fact, much more than the quadrant or wave reports, these reports are embellished with several pages of trends insights that inform both buyers and vendors alike about what is most important when investing in the upcoming project.

Research In Action Reports are Widely Read

When Research In Action publishes its reports, they are made available to several communities:

- Survey respondents. The 1,500 marketing software decision-makers who answered the survey questions are provided with the full report as feedback

- Survey panel. Research In Action maintains an active survey panel on a global basis with contact details and topics of interest: a current total of 125,000 IT Automation decision-makers and 90,000 Marketing Automation decision-makers. These panel members are informed of the report and can download it if desired

- Website visitors. Any viewers of the Research In Action website sees a “public version” without the exact scores and matrix placements of each vendor (to save their embarrassment) but with all insights and the most important facts on each vendor.

- Vendor reprints. Research In Action does also license reprints, where a vendor can distribute a copy of the report, with their detailed profile, to interested parties.

On average, each report gets tens of thousands of clicks on our website. Personally, I am quite proud that so many people now get to see my work. And, when I am booked to do speeches and webinars, I know they are booking me personally, not the brand power.

Our work really does fill that gap between an industry analyst report focused on large enterprise needs, and the “trip-advisor” type of review websites. They also reach and assist a broader community of software buyers. Lastly, the community reading the reports is probably a whole order of magnitude higher than the audience able to access the “Tier One” research reports. Here is our latest Market Impact statistics chart.

Always keeping you informed! Peter

-

Martechopia exhibits event vendors

On my first business trip since years, I attended B2B Marketing’s Martechopia event in London earlier this week. As usual, it was a mix of insightful presentations and discussions by the rich team of experts that the organization is always able to collect for their events. Also, my latest Propolis research report for B2B Marketing entitled ”Riding the Wave of Martech Change” was launched at the event.

But I was even more intrigued by the sponsors that exhibited. This was traditionally a mix of a few marketing automation platform vendors, various other software vendors, plus a few agencies – typical providers that target B2B marketing executives as prospects. Well, the big names were not there but a new rising star, the Californian analytics and account engagement platform vendor, 6sense, was present in recognition of their new office in London. Spoiler alert: the day before, I had recorded a video/webinar for them about Account-Based Marketing in Europe to be published in the next weeks.

The intriguing thing was that there were THREE marketing event management (MEM) vendors with booths – I also met event attendees representing two further MEM vendors during the day. It looks like I was right in my prediction in the December 2021 Vendor Selection Matrixtm on Marketing Event Management – that investments for marketing event platforms is going to become part of the B2B marketing budget in the next years.

In their stage presentation, MEM vendor Cvent even admitted that they had totally ignored Marketing as a target buyer till now, they were only focused on event managers (who are not in marketing). That is true; when I contacted them for the MEM research last September, they declined to brief me because I (only) write for marketers. Well, now they are playing catch-up to address exactly that audience.

The other two MEM vendors displaying at Martechopia were in the Top Five in my December report: ON24 and SpotMe. My colleagues at B2B Marketing are now even using SpotMe as their event platform – I had shared my research with them last year, of course. Another spoiler: there is a webinar with ON24 and myself in the works.

My perception was that the staff at both vendors were very good about talking about marketing topics to the delegates instead of event management stuff like registration processes and ticketing. I see MEM becoming an integral part of the customer engagement lifecycle monitored and orchestrated by marketers – from initial kicking-the-tyres curiosity through to offering a Netflix-style library of videos and webinars, most of it collated out of the event calendar. As I write in the report:

- The crisis has accelerated the inevitable. Large Virtual Events are now SOP and many businesses will plan these as routine in their marketing calendars. Webinars are now an accepted marketing tool across most sectors and geographies.

- Over one half of companies used between six and ten vendors this year – most did not have a centralized procurement strategy for this topic. Expect his to change for 2022.

- Nearly three quarters of companies have serious difficulties monetizing their events efficiently. Over half have issues with supporting international audiences, managing presentation content, event registration and ticketing.

I suspect the vendors probably did not collect that many “leads” this year, but they have certainly put their stake into the ground and will be top-of-mind when the strategic MEM projects get budgeted this and next year.

Always keeping you informed! Peter

-

MAP Research Nearly There

I am almost finished with my next Vendor Selection Matrixtm on Marketing Automation Platforms (MAP) – the draft is with the vendors for fact checking. Here are some highlights that will, hopefully, make you more curious about the full report.

Our method of asking business managers to name software vendor(s) they associate with a certain topic collects the list of all vendors that are currently top of mind on the practitioner side. In this case we provided a definition and asked about their “Marketing Automation Platform” and the vendor landscape discovered will surprise some people and vendor staff will see new competitors they had not yet considered. Perception is reality. Most vendors were also scored highly, a sign of a mature market, but the survey results also

make it clear that expectations from marketing executives of MAP vendors have now changed dramatically.

More and more companies are now focusing on digital marketing programs as society and business reacts to the COVID-19 crisis. In parallel, the focus of digital marketing itself is moving from the simple realization of new business leads to a more engaging and relationship model, raising questions on MAP functions now needed, questions such as: is lead management or engagement management the main function required now?

Nearly three quarters of companies are using the MAP more than previously with over half of those companies are leveraging it for more products and services than before and/or for greater market coverage. The crisis has accelerated the inevitable and the increased dependency on digital marketing has exposed weaknesses in many MAP installations. So, it is no surprise that our survey found that 83% of the companies who have a MAP are actively reassessing the suitability of their current installation. 11% are already replacing their MAP. Another 24% of the respondents know they must migrate to something new and 50% know this will be the case for them soon.

63% claim that they are not getting the promised return from their MAP (46% citing that as a BIG problem). 91% have issues integrating the MAP to other systems with, again, the share citing that issue as a BIG challenge is well over 40%.

The re-assessment wave varies across the key regions of the world with North American enterprises already well into the replacement phase. Although there are 12 market leaders, ONLY 13% of companies are satisfied with their current MAP functionality – or just 10% in North America and in Europe.

Two thirds of companies lack the time/resources to use their MAP effectively while a similar proportion complain about lack of support, or over-promising, from the vendors (40% call this is a BIG challenge).

So, watch this space at the end of this month for more data and insights.

Always keeping you informed! Peter