-

Propensity to Switch Vendors

This year, I have collected several new Recommendation Index (RI) values from the Vendor Selection MatrixTM reports we have published. I see the RI as a significant leading indicator of long-term customer satisfaction but also, more importantly, of the propensity to switch indicated by customers. It is for that reason that we have included the points earned through the RI score in our Strategy axis on the matrix and give it a significant 25% weighting.

In our surveys, we actually ask about two items directly related to customer retention: the current satisfaction, and the “would you recommend this vendor?” question. Customer satisfaction is defined as a measurement that determines how happy customers are right now with the solution being evaluated and flows into the Execution axis of the matrix. The RI (the simple percentage of respondents who answer “yes”) encapsulates a longer- term, more strategic element of customer satisfaction – essentially it is a measurement of customer loyalty.

Vendors. I think that any RI 95% or over is satisfactory but an RI twixt 90 and 94% should raise some alarm signals about your customers’ emerging propensity to switch, while below 90% is already a state of alarm.

Buyers. You should interpret the numbers in a similar manner.

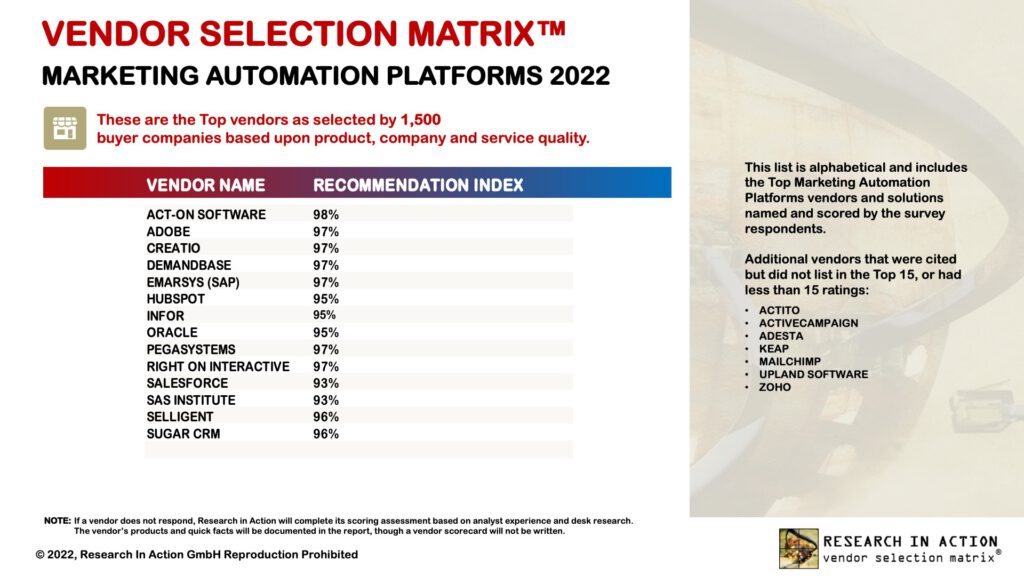

The data below shows that the vendors listed in our Marketing Automation Platforms (MAP) landscape include several that should feel threatened by a propensity to switch. Our survey also showed that 49% of the respondents were planning to replace their MAP with something more suitable while another 24% said that was under consideration – always a moment of truth for a supplier if your client is not really satisfied with their overall experience. And remember, these are the 15 or so vendors with the top scores – there are many others with lower numbers.

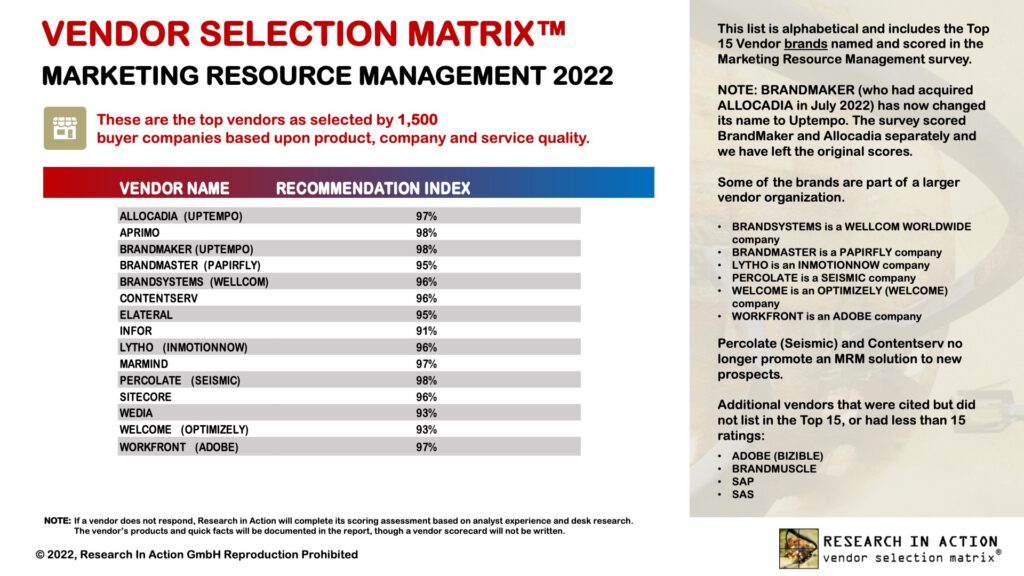

The next survey in 2022 was around Marketing Resource Management (MRM). Again, there are some vendors that should feel threatened by a propensity to switch.

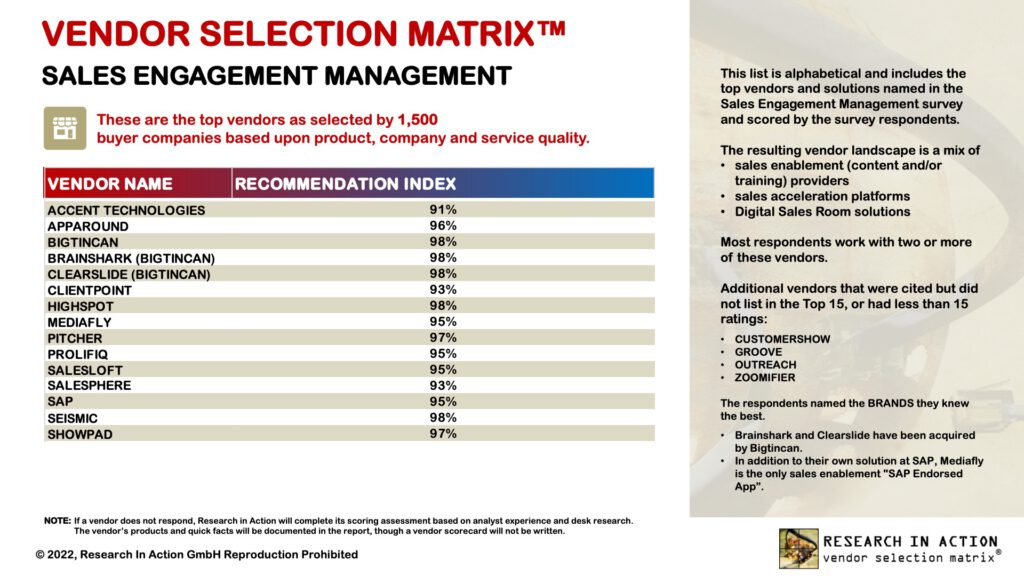

We have also published our report on the top Sales Engagement Management (SEM) vendors as rated by our global survey of 1,500 practitioners. There is already a lot of churn in this market as businesses race to replace their older SEM platforms with a more capable and holistic solutions for more digital selling and marketing. However, there were not that many vendors at 94% or below.

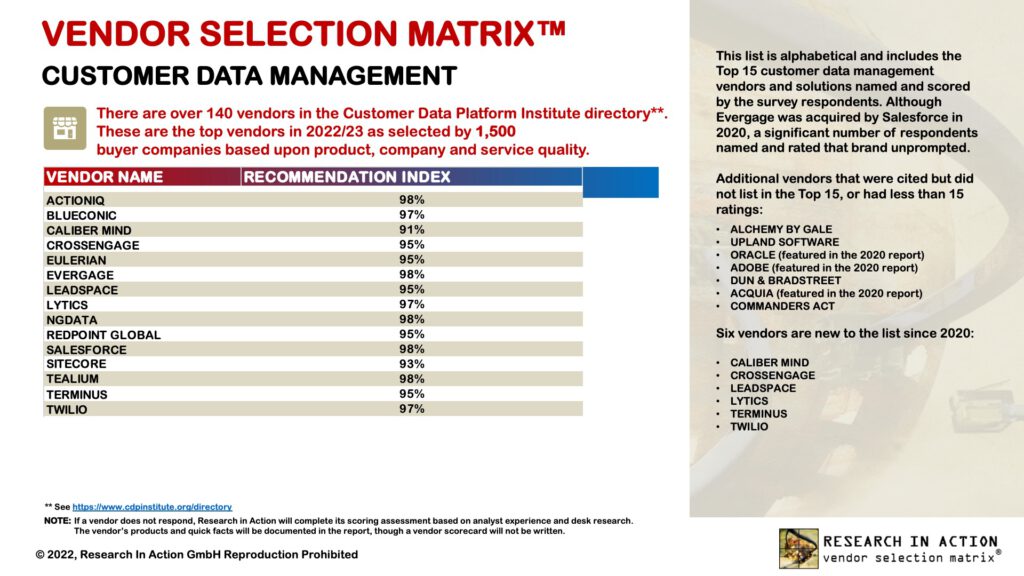

This month we published our report on Customer Data Management. The table shows an impressive scoring of all Recommendation Index values in the high 90s with just two below the 95% number that I would set as an alert.

Overall, the numbers are good for these leading vendors. We’ll see how this analysis progresses in the 2023 surveys we have planned.

Always keeping you informed! Peter

-

Seismic Top Again in SEM

Sales Engagement Management (SEM) processes are transforming in most companies. B2B buyer behavior has evolved to become primarily digital, so traditional in-person selling is no longer the norm with 70% of business decision-makers now open to fully self-serve or remote purchases even if more than $ 50,000, according to McKinsey.

I’ve just published my 2022 Vendor Selection Matrixtm research on Sales Engagement Management which shows that increasing digital marketing and sales means that automated sales strategies and analytics have now joined the SEM process family. Indeed, in many companies, the sales organization includes a new generation of customer success managers, with different informational needs to the traditional salesperson. We estimate that 40-45% of companies have automated, or will be automating, parts of the SEM process in 2022.

Great SEM is now more important than ever.

The COVID-19 pandemic has set off a period of head-spinning change in many companies, even industries. Digital transformations are being realized faster than ever thought possible. Firms go digital in a matter of days, not years, and offer new services almost overnight. And one of the most drastic consequences of the move to digital marketing, selling, and buying, is on the role of that traditional salesperson (note that I co-wrote the Forrester report “Death of the B2B Salesman” back in 2015). Some of us analysts and vendors are starting to propose the broader descriptor Revenue Enablement or Revenue Management, where Revenue is an aggregation of sales and retention rate, most of which is automated and digital.

We asked why marketers need SEM.

We asked, “Which of the following processes do you plan to automate with your SEM system?”, providing a list of 17 possible processes. The highest NEW interest is in improving Guided Selling and Pipeline Management, followed by support for Video Selling (aka remote selling). The next two priorities are being able to provide data and analytics (including alerts and recommendations) to salespeople.

SEM investment drivers depend on geography.

Overall, nearly one half of companies are focused on sales content management while 29% cite integrating to other marketing asset systems as important. One quarter value the opportunity to support social selling. However, these priorities vary across the regions. Social selling seems to be more important in Europe, as is Content control. More American companies are still working on providing relevant content assets to salespeople and to integrate to other systems while the more strategic benefit of improving revenue operations is recognized by four times as many European executives compared to North American.

SEM improvement has a “sense of urgency” due to eCommerce.

As cited above, eCommerce has affected the sales process in almost all B2B companies. A resounding 98% of respondents expect the share of their products/services sold online to increase dramatically, reducing the dependency on a field sales force. But the Inside Sales (BusDev) function requires more, but also different, SEM functions.

Pure-play SEM vendors may not be able to keep up.

As part of an overall trend towards adopting more capable revenue management technology, SEM vendors will be challenged by existing Account-Based Marketing and Customer Data Management vendors. Many of these vendors will already have a strategic supplier relationship and can provide “just-enough” SEM capabilities to lock out a pure-play SEM vendor.

But what is the market saying?

The clear #1 Global Leader, as scored by the survey and me, is the vendor Seismic, who have won this leadership position for three surveys now.

This is the full list of all Market Leaders (having both a Strategy and an Execution score of over 4 out of 5) in the Vendor Selection Matrix™ – Sales Engagement Management 2022 (listed alphabetically):

APPAROUND, BIGTINCAN, BRAINSHARK (now BIGTINCAN), CLEARSLIDE (now BIGTINCAN), HIGHSPOT, MEDIAFLY, PITCHER, SALESLOFT, SEISMIC, and SHOWPAD.

Note that the vendors BRAINSHARK and CLEARSLIDE were acquired by BIGTINCAN this year. However, the brands were named and scored, unprompted, in the survey.

The full list of vendor brands in the Top 15 vendors scored in the survey is completed by:

ACCENT TECHNOLOGIES, CLIENTPOINT, SALESPHERE, SAP, and PROLIFIQ

The link above connects you to the public version of the report, with the alphabetical list of market leaders and shorter vendor profiles. Watch out for several versions of report in full detail over the next months as several vendors distribute their licensed reprints.

Always keeping you informed! Peter O’Neill

-

Sales is different now, so Sales Engagement Management must change too

We are almost there. I have now completed my 2022 Vendor Selection Matrix research on Sales Engagement Management, the survey has been analyzed, insights and trends have been written up and the vendor scorecards/profiles completed. The report is now with those vendors for fact checking and we expect to publish in October.

The need to automate elements of sales engagement management (SEM) was proposed many years ago (I would claim to be that analyst in question) but not readily adopted in all companies, especially those dominated by a Chief Sales Officer. But the COVID-19 pandemic has set off a period of head-spinning change in many companies, even industries. Digital transformations are being realized faster than ever thought possible. Firms go digital in a matter of days, not years, and offer new services almost overnight.

And one of the most drastic consequences of the move to digital marketing, selling, and buying, is on the role of that traditional salesperson (again, let me note that I co-wrote the Forrester report “Death of the B2B Salesman” back in 2015).

Our survey of 1500 business professionals on this topic shows the highest NEW interest in improving Guided Selling and Pipeline Management, followed by support for Video Selling.

The next two priorities are being able to provide data and analytics (including alerts and recommendations) to salespeople. SEM projects are mostly executed by more mature companies and based on our conversations with users and vendors, we estimate that 40-45% of companies have automated, or will be, their SEM process in 2022-23.

When we asked them about their 2022 SEM projects, nearly half of the companies were still focused on sales content management, the earliest implementation phase of SEM. Nearly a third say that integrating to other marketing asset systems is important, and a quarter value the opportunity to support social selling. However, these priorities vary across the regions which we explore in the report in more detail. The project drivers have also changed dramatically since our last survey in late 2020.

These are the 15 vendors that qualify for the Vendor Selection Matrix™ – Sales Engagement Management 2022 due to their scores in the survey and me (listed alphabetically):

ACCENT TECHNOLOGIES, APPAROUND, BIGTINCAN, BRAINSHARK, CLEARSLIDE, CLIENTPOINT, HIGHSPOT, MEDIAFLY, PITCHER, PROLIFIQ, SALESLOFT, SALESPHERE, SAP, SEISMIC, and SHOWPAD

Watch out for the final version of the report in full detail next month.

Always keeping you informed! Peter O’Neill